Adding direct taxes to the product price on Shopify is a smart and efficient move, especially when you’re selling the product in different regions where the tax policies and regulations are different. Reduce cart abandonment and make your tax process smoother by allowing the customer to display the tax-inclusive price in advance instead of showing the price at the time of checkout. In this article, we will explain how you can show the tax-inclusive prices in your Shopify store easily. So let’s get started!

Step-by-Step Instructions: How we Include Tax in Product Price on Shopify

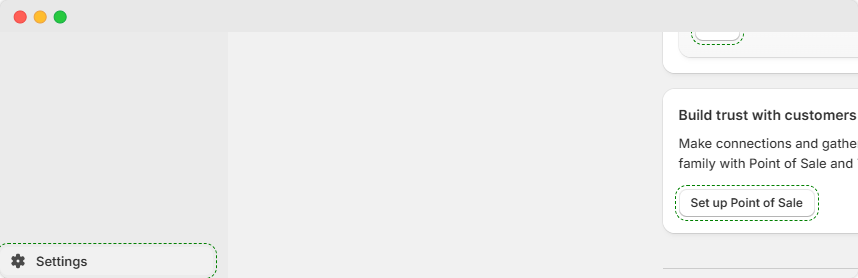

Step 1: Navigate Shopify Admin view

Log in to your Shopify Admin view, and click on the Settings option at the bottom of the dashboard.

Step 2: Access Tax settings

Once you open the settings view, click on the “Taxes and Duties” option.

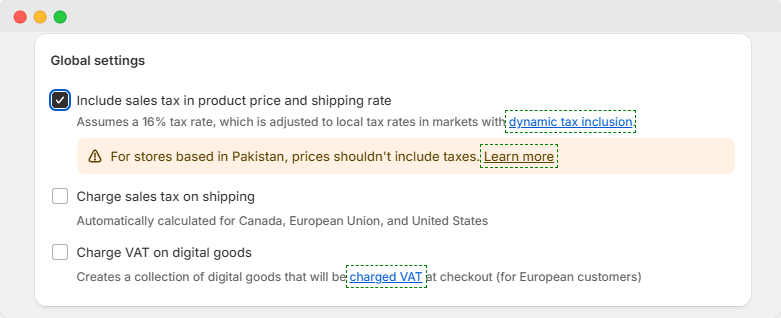

Step 3: Global Tax Settings

- Scroll down and click on the “Global Setting” section.

- In this view, you will see a setting where you can add the direct text to the product price.

- Click on the “Include sales tax in product price and shipping rate” option.

This means that tax will automatically be included in the product price that is shown on the product page. If you uncheck the box, customers will be able to see the price of the product without tax.

For example, if you list the price of a product for $200 and you have a 20% tax in your area, the total checkout price is (Price + Tax) or $240. In order to calculate that, the formula is

Total Price = Product Price * (1 + Tax)

So $200 * 1.2 = $240.

Depending on whether you checked or unchecked the box that includes tax or not, it will determine your ability to see the price where tax will already be included easily.

In the case of the last example, where we have the same goal to keep the final price as $200, and we know we are going to include taxes, Shopify does this as follows:

The product price will be estimated by

Tax = (Tax Rate x Price) / (1 + Tax Rate)

The value of the product: $166.67

Tax: $33.33

In another example, if I use a tax rate of 20%, I would have a price that would be the price of $83.33, and the tax would be $16.67.

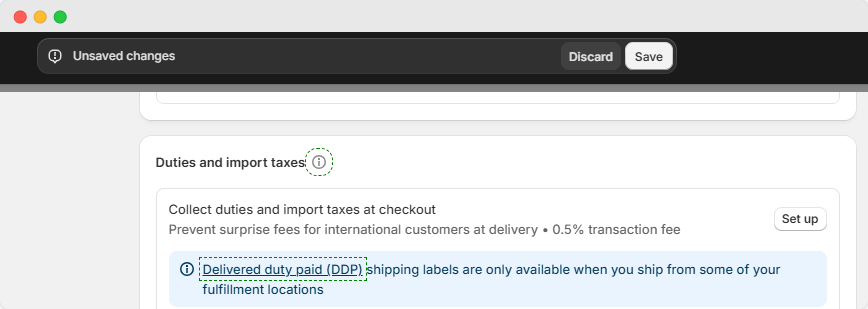

Step 4: Save Changes

Once all the modifications are completed, click on the “Save changes” option to implement all settings.

Why Does Customer Clarity Matter?

According to recent research, over 50% of carts are abandoned in online stores due to adding the direct tax to the actual product price, which is displayed at the time of checkout. Due to this reason, most of the potential customers leave the store without buying anything. If the store owner displays the product price by including or excluding the tax price, it can boost customer trust and store conversion.

Price transparency creates trust and credibility. For example, if customers know about the product price without any hidden surprises at checkout, they prefer to complete the purchase with confidence instead of abandoning the cart.

In short, clarity of prices or displaying the final prices upfront can build transparency, increase your customer trust, improve your store conversion rate, and shopping experience.

Boost Customer Clarity with Shopify Taxes Included in Prices Option

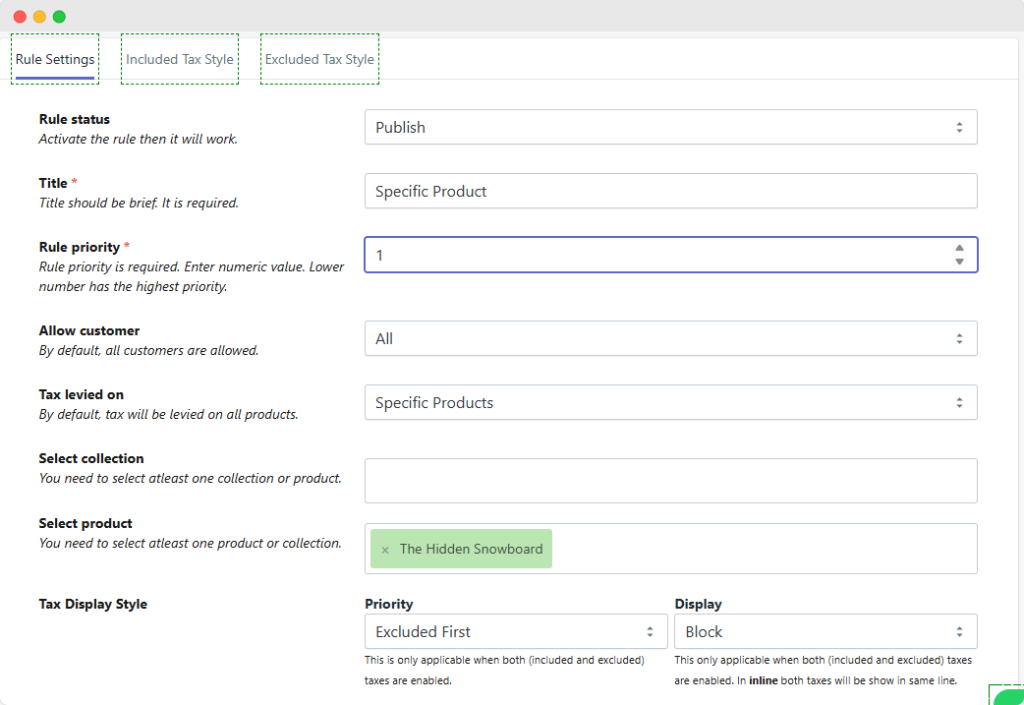

By default, Shopify does not have a built-in feature to show product prices with or without tax. Now you can use the Shopify app “Price Before & After Tax” by Addify apps. A powerful app that gives you the ability to display pricing that is inclusive and exclusive of tax.

With the this app, you can set rules to show the actual price of a product with tax and the tax amount. Additionally, this app can also automatically calculate and display pricing according to the local tax laws based on the country, because each country has its own laws or regulations on taxes.

If you can provide clear tax-inclusive and exclusive pricing on your store, it can reduce confusion between the business and customers, which increases your store conversions.

Key Features of the Shopify Price Before & After Tax App

The Shopify include tax in price app offers robust features designed to help merchants manage tax-inclusive and tax-exclusive pricing with ease:

- Rule-Based Management:

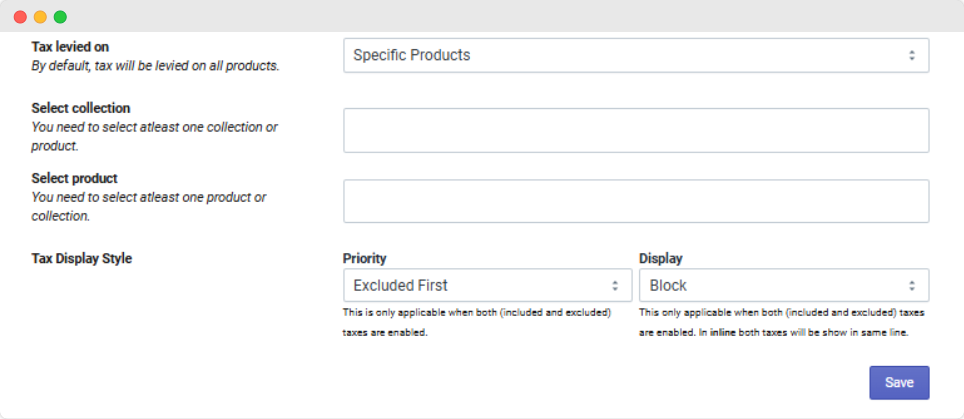

The shopify taxes included in the price app will allow you to create customized rules based on desired conditions such as product, categories, tags, and location. It allows you to display the price by including or excluding tax by using this rule.

- Display with & without VAT:

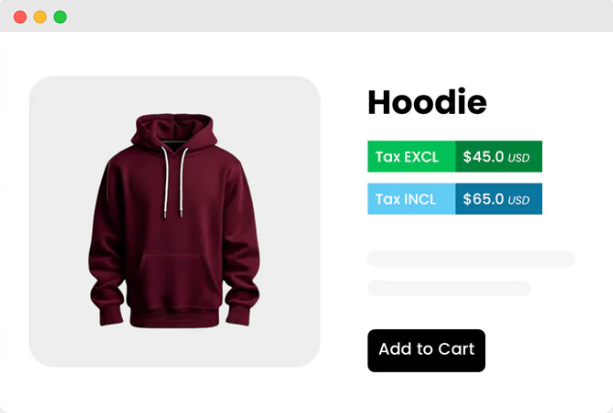

With the Addify app, you can display the price by including or excluding the tax on the product and collection page, along with the product. Displaying the tax with the price can help the customer to compare both tax-inclusive and exclusive prices easily. For example, a jacket’s actual price is $45.5 after applying the tax, the price will be $65.0. Both prices will be displayed on the product page. Making the purchase decision easier for customers.

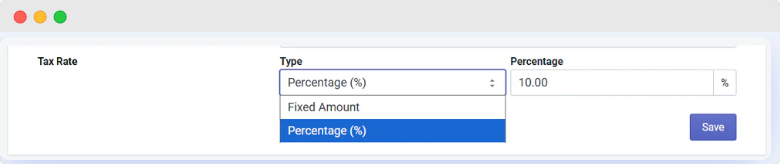

- Fixed or Percentage Taxes:

You can apply the tax based on a fixed amount or a percentage of the product price. To provide flexibility, you can set the rule according to your store’s needs and regional regulations. For example, you can offer a flat $5 tax on a product or apply a 10% tax rate that can adjust automatically based on product price.

- Targeted Application:

With this add-on app, you can levy tax based on specific products, tags, or categories that help to target a specific audience. For example, charge the tax on the luxury item to target the specific audience or charge the tax on a wholesale item to target the retail customer.

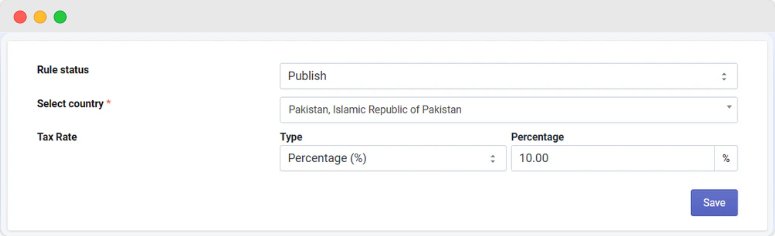

- Make International Transactions Easy:

Offer the global sale by applying the inclusive or exclusive tax, based on a specific country’s regulation. With this international support, you can adjust the tax according to the requirements of the country. For example, a person operating in Canada and the US is required to display the product price including tax, but on the other hand, India requires the product price without including any tax.

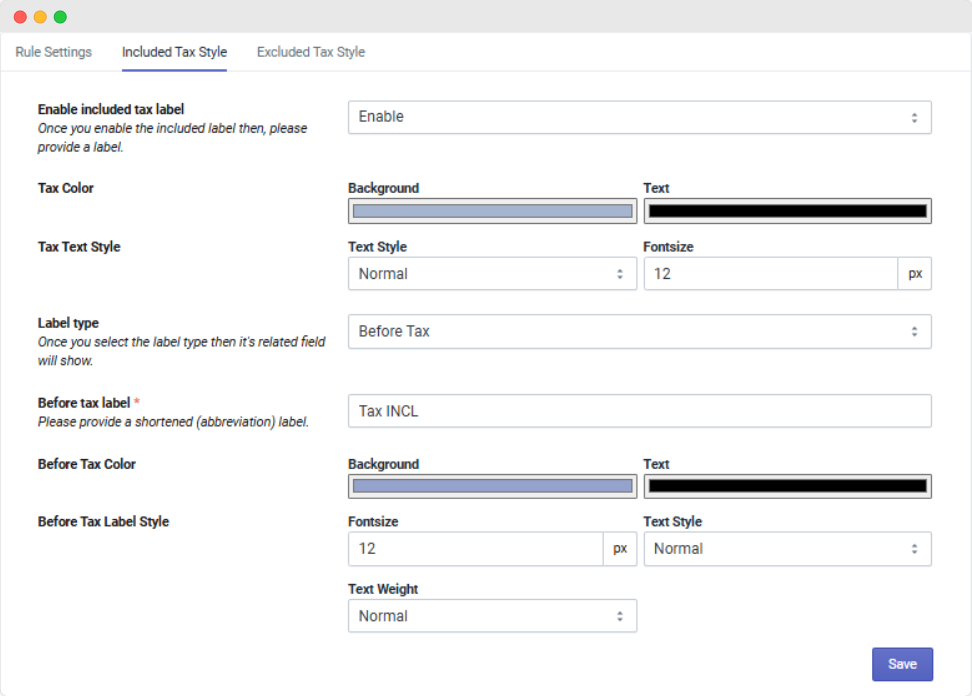

- Customizable Labels & Colors:

Shopify includes tax in the price, allowing you to customize the price text on the product page. You can adjust its background color, text color, font size, font style, or label style or size according to your preference.

- Serving Both B2B and B2C Customers

Automatically display the inclusive or exclusive tax price based on customer tags. For example, if a B2C customer buys the product, they will see the tax-inclusive price, and if a B2B customer purchases a product, they will see the tax-exclusive price. This process can easily manage the bulk order and provide flexibility to the customer based on their tags without any manual effort.

Key Benefits of Including Tax in Price

Some key benefits are:

- Providing transparency in price can build your customer trust.

- Displaying the price by including or excluding the tax can reduce cart abandonment because customers know about the price before going to the checkout.

- Provide flexibility to adjust the product price according to the country’s tax regulations, which can increase your store conversion.

- Boost your customer shopping experience by adding and displaying the tax-inclusive price before checkout.

Conclusion:

Transparency from total, tax-inclusive pricing = better customer clarity. When they see the price upfront, the customer feels informed, and there are no surprises at checkout. Having this pricing clarity leads to customer trust and loyalty with your store. Customers can finalize their orders without abandonment and will bring more trust, which improves credibility, strengthens conversions, and improves adherence to regional tax requisites. Using Shopify’s tax settings or utilizing an equally powerful app like Price Before & After Tax to manage inclusive and exclusive pricing in different markets, for different customers, or for different business models is a very easy process.

Make your checkout process stress-free for your customers by updating your Shopify tax settings today, which can build long-term trust and increase sales.

FAQs:

Q1: Why should we include taxes in product pricing on Shopify?

Ans: Including tax in your prices promotes transparency, decreases cart abandonments, and prevents issues with tax compliance in places where tax-included pricing is required.

Q2: Can I show both tax-inclusive and tax-exclusive prices at the same time?

Ans: Yes! If you use apps like Price Before & After Tax, you can show both versions of the prices on product pages and collection pages.

Q3: Does this apply to international sales?

Ans: Yes. You can create rules so that the prices are shown as tax-inclusive or tax-exclusive based on the customer’s shipping country.

Q4: How does this benefit B2B & B2C customers?

Ans: You can seamlessly show tax-exclusive prices for B2B customers and tax-inclusive prices for B2C customers using customer tags.

Q5: Is it complicated to set up tax-inclusive prices in Shopify?

Ans: Not at all. If you get the right App, you can manage the rules, customize the labels, and automate without any technical effort.